No matter your business’s size, you need business accounting software to automate and optimize your operations. While there are numerous options, FreshBooks is one of the best, especially for small businesses.

FreshBooks is a cloud-based accounting solution and one of the best invoicing software for small businesses. It accommodates all your bookkeeping and accounting processes, making it simple to generate and send invoices.

Popular for its user-friendly and mobile platform, FreshBooks offers three different packages with a range of features to suit various businesses’ needs.

This FreshBooks review explores what the software has to offer, providing you with all the information you need to decide if it’s right for your business.

FreshBooks overview

Michael McDerment founded FreshBooks in 2003 after accidentally saving over an old invoice while operating a small design agency. He embarked on a mission to create a solution that would prevent such mishaps, and that’s how FreshBooks was born.

Today, the company has more than 300 employees and is a top-rated cloud-based accounting solution for small businesses. The Toronto, Canada-based company has raised approximately $75 million in funding from investors like JP Morgan Chase.

The company is committed to helping small business owners automate, streamline, and optimize their operations with its 4E philosophy — to Execute Extraordinary Experiences Everyday.

Who is FreshBooks for?

If you’re a first-time consultant or just entering the business world and are looking for a reliable and user-friendly accounting solution, look no further than FreshBooks. This accounting software is ideal for freelancers, consultants, sole proprietors, micro-business, and small-business owners.

The software offers a Self-Employed edition for solopreneurs and a Team edition for small businesses with employees and contractors. FreshBooks’ support is highly responsive and is an excellent option if you value readily-available customer support. They offer a website contact form, human-managed email, and toll-free numbers.

FreshBooks key features

FreshBooks has numerous valuable features. Let’s explore the main ones.

Simple and intuitive interface

One of the primary reasons many businesses choose FreshBooks accounting software is that it features a simple, easy-to-understand, and intuitive interface. More than five million people utilize paperless billing in this accounting software because it doesn’t have complicated features.

Invoice to payment functionality

FreshBooks has reliable invoice to payment features that are valuable for small businesses. It offers many tools to help you keep track of old and current invoices. Besides being able to track exactly when a client opens your invoice email, you can quickly find any pending invoices from past months.

This software also allows you to send overdue payment reminders to clients automatically. It provides excellent flexibility when it comes to managing payments. You can settle accounts with MasterCard, Visa, or American Express for credit card processing.

You can also use PayPal for online transactions. This accounting software streamlines cloud invoicing with an online payment gateway, ensuring you have an efficient way to collect payments without discussing the issue directly with your client. It helps you save time by automating the recurring billing process.

What’s more, FreshBooks offers multi-currency invoicing, allowing you to bill your clients in local currency.

Expense tracking

Expense tracking plays an integral when it comes to creating your business budget. Tracking your expenses by keeping records of receipts, invoices, and other payments helps improve your budget’s financial success. Expense tracking enables you to stay on top of your cash flow and prepare for tax season.

FreshBooks has an excellent, easy-to-use expense tracking feature. Simply take a picture of the receipt and attach it to an item in FreshBooks to record the expense. This feature makes it easy to track payments from various clients.

You can also easily add an expense to an invoice as a reimbursement deal with a client. Additionally, you can import expenses directly from your bank by linking the Expense Tool to your bank account or credit card. With all these capabilities, you can easily track your company’s daily, weekly, and monthly expenses.

Time tracking

Many businesses find it challenging to calculate the overall time taken to accomplish specific projects. You can avoid this challenge by integrating your payments into FreshBooks. This accounting software has an efficient time-tracking feature that allows you to manage and keep track of time and money spent on a project.

If you’re in the field, you can use the feature to record your working time accurately, and easily convert your work timesheet into an invoice and send it to clients.

This software’s billing features allow you to set your time-tracking to an hourly or flat rate depending on the project’s requirements. The time-tracking feature allows your employees to log in their time separately for every project, helping you track individual and overall time progress to quickly calculate your clients’ bills.

Seamless project collaboration

FreshBooks allows you and your team to seamlessly work together to ensure you accomplish each task, meet your targets faster, and deliver results more efficiently. To implement seamless project collaboration, you’ll need to invite your team members, business partners, and other stakeholders to perform project tasks together.

You’ll need to agree on the files you can make accessible using FreshBooks’ team permissions setting. The software allows you to conveniently keep all project files, messages, and other critical information in a central place. You can rest assured that everyone involved in the project is in sync and meets all targets.

FreshBooks’ has a range of features to facilitate seamless project collaboration and efficient project management. Some of the features include:

- Project status overview

- Task deadline dates assigning

- Client rate/hour assigning

- File sharing

- Live chat

With FreshBooks, you can quickly generate financial reports by processing already entered data. The software allows you to create profit and loss reports with only a few clicks. What’s more, you can create expense reports, allowing you to view various types of information, such as the current month’s total costs and balance sheets, in real-time.

Additionally, this accounting software streamlines the taxation process. You can easily filter through your financial records and produce accurate tax reports. FreshBooks allows you to export your reports to various formats, such as a CSV file, so you can easily share them with tax advisers or accountants.

Contact management real-time reporting

FreshBooks’ contact management feature lets you add necessary customer information and internal notes. It also allows you to set a default language and currency and create default reminders and late fees for each client.

This app also features a well-designed client page with graphs showing total funds overdue, the amount outstanding, and the amount in the draft. Below the chart is a list of recently active customers and a detailed client directory.

One of the most remarkable attributes of the contact management feature is that you can quickly send statements directly to your customers.

Multiple currencies compatibility

FreshBooks is compatible with over 170 different currencies and 14 languages. This capability makes the software ideal for international business and invoicing.

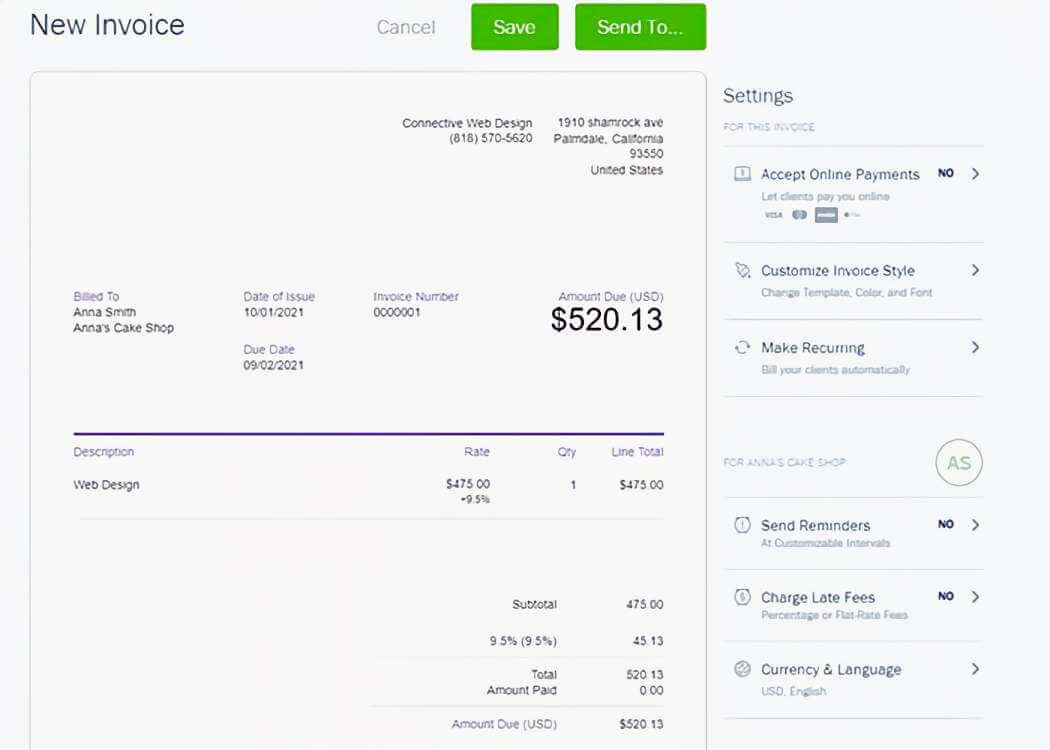

Context-sensitive settings

One feature that sets FreshBooks apart from its competitors like QuickBooks is the ability to display links to context-sensitive settings as you prepare your invoices. Besides saving time, it reminds you of available options.

Some of the tasks you can accomplish with the context-sensitive settings include:

- Switching to a different invoice style

- Making the invoice recur at specific intervals

- Setting up online payments

Context-sensitive settings appear once you save an invoice. This feature also allows you to reopen and edit any saved invoices. When you click the More Actions button, you’ll have access to additional functions, including:

- Emailing the form

- Applying for a payment

- Generating a PDF file

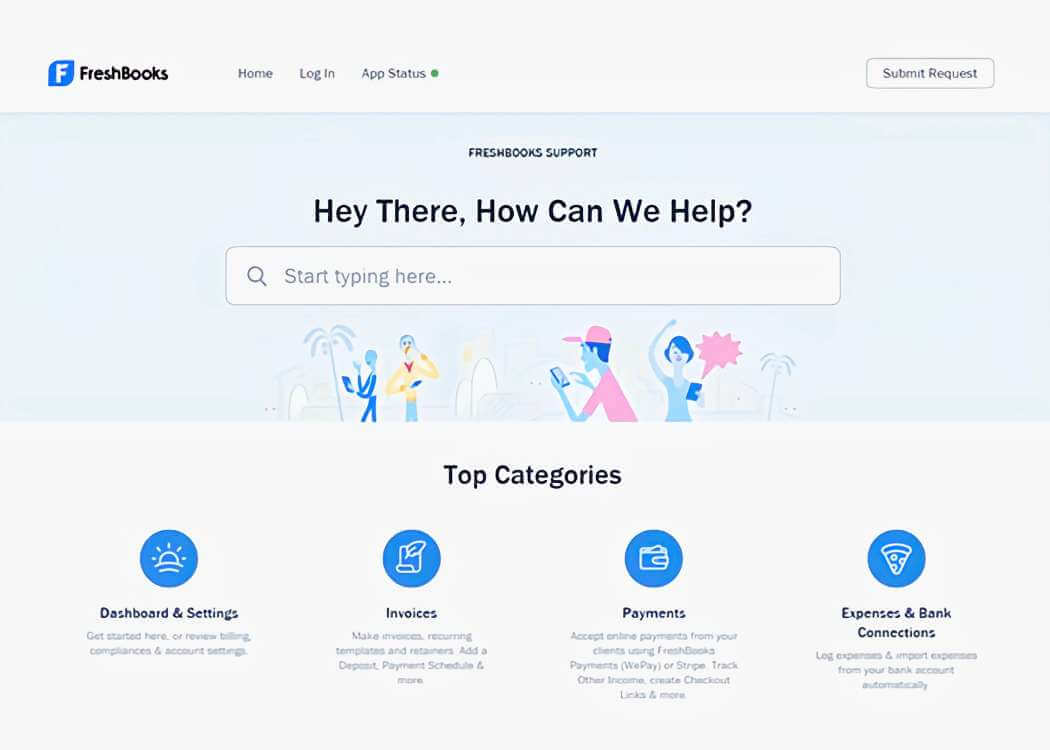

FreshBooks customer support

One of the factors to consider when choosing accounting software is reliable customer support. FreshBooks offers an exceptional customer experience, excellent resources page, and webinars to help you get the most from the accounting software.

If you have any issues with the software, you can contact customer service 24/7 year-round. You can reach the FreshBooks support team by phone, live chat, or email. You can also find solutions at the Knowledge base.

According to many users, FreshBooks customer representatives are hospitable, knowledgeable, and helpful in resolving issues.

FreshBooks pricing

FreshBooks offers four competitively priced plans to meet the needs of different business owners and depends primarily on the number of clients with whom they work. You might want to consider purchasing FreshBooks’ annual subscription instead of paying monthly, as it will save you 10%.

Before you decide on the best plan for your needs, you can take advantage of the 30-day free trial to see how all the features work. Let’s explore the different FreshBooks plans and their costs.

The lite plan

If you’re just starting your business and have less than five active clients, the Lite plan is ideal for you. It costs $15 per month and allows you to bill up to five clients. Thanks to its lower cost, the plan is also great for keeping control of your expenses as you develop your business.

With the Lite plan, you can link FreshBooks to your bank account, track time, and accept invoice payments online. The best thing about this plan is that you can easily upgrade to the next plan whenever your business outgrows it.

The plus plan

Most business owners choose the Plus plan as it offers several advantages over the Lite plan, especially for growing businesses. The plan costs $25 per month and allows you to bill up to 50 clients.

In addition to all the features of the Lite plan, you can also charge late fees and send automatic payment reminders, recurring invoices, and proposals. It uses double-entry accounting and lets you run financial reports.

Thanks to its 50-client limit, this plan allows you to maintain your main clients in addition to a growing list of one-time or seasonal clients. The Plus plan includes features that will help you realize faster business growth.

The premium plan

If you have several hundred clients and you’re looking for an easy way to bill them, manage multiple clients, and keep your paperwork organized, the Premium plan is ideal. The plan costs $50 per month and comes with every Plus plan feature, but it allows you to bill up to 500 clients.

The select plan

If you have more than 500 active clients or bill more than $150,000 annually, the Select plan is the best option for you. This plan offers personalized pricing, and you’ll need to contact FreshBooks customer service to get a quote for your specific needs. On top of the Premium plan features, you also get a dedicated account manager to work with you.

Regardless of the plan you choose, the company gives you the option of paying monthly or yearly. Remember, you’ll save 10% if you opt for an annual payment. With any FreshBooks plan, you can do the following:

- Create professional-looking invoices

- Accept credit cards online for faster payments

- Send estimates to help you win jobs

- Utilize reliable time tracking

- Automatically import expenses to track spending

- Access comprehensive reports with useful business insights

- Organize project budgets to keep your team on track

You can also choose add-ons with any plan to improve your operations. Here are some of the most useful FreshBooks add-ons:

- Additional users add-on costs $10 each per month. This applies to employees, business partners, and contractors you add to your account. It excludes accountants, as you can invite them to access your account for free.

- FreshBooks payments add-on costs 2.9% plus 30 cents per transaction and lets you accept payments online. You may also opt to link your Stripe account to the system.

- Advanced payments add-on costs $20 monthly plus 3.5% and 30 cents per transaction. With this add-on feature, you get a virtual terminal that lets you accept payments in person and over the phone. It allows your clients to authorize payments.

FreshBooks mobile apps

FreshBooks offers iOS and Android apps that allow you to work on the go. With FreshBooks’ mobile apps, you can stay in touch with your team members and clients and manage your accounting and project tasks anytime, anywhere.

The apps have a user-friendly interface, but the user experience is not as impressive as what you get on the main site. Nonetheless, you can perform virtually all FreshBooks tasks with the mobile app.

With the mobile app, you don’t need to be in the office to create professional invoices. You can also quickly capture and log your expenses by simply taking a picture of the receipts. The mobile app also allows you to respond to clients or team members’ queries promptly.

Besides the ability to keep all conversations in one place, you will be notified immediately when an invoice is overdue or when a client checks their invoice. Additionally, all actions are automatically synchronized in both mobile and desktop devices, ensuring everything stays up-to-date.

Another remarkable feature of FreshBooks’ mobile apps is automatic mileage tracking. When you run the app with Location Services on, it tracks your mileage as you drive. It lets you record trips as business or personal, and you can go back and add trips that you may have missed.

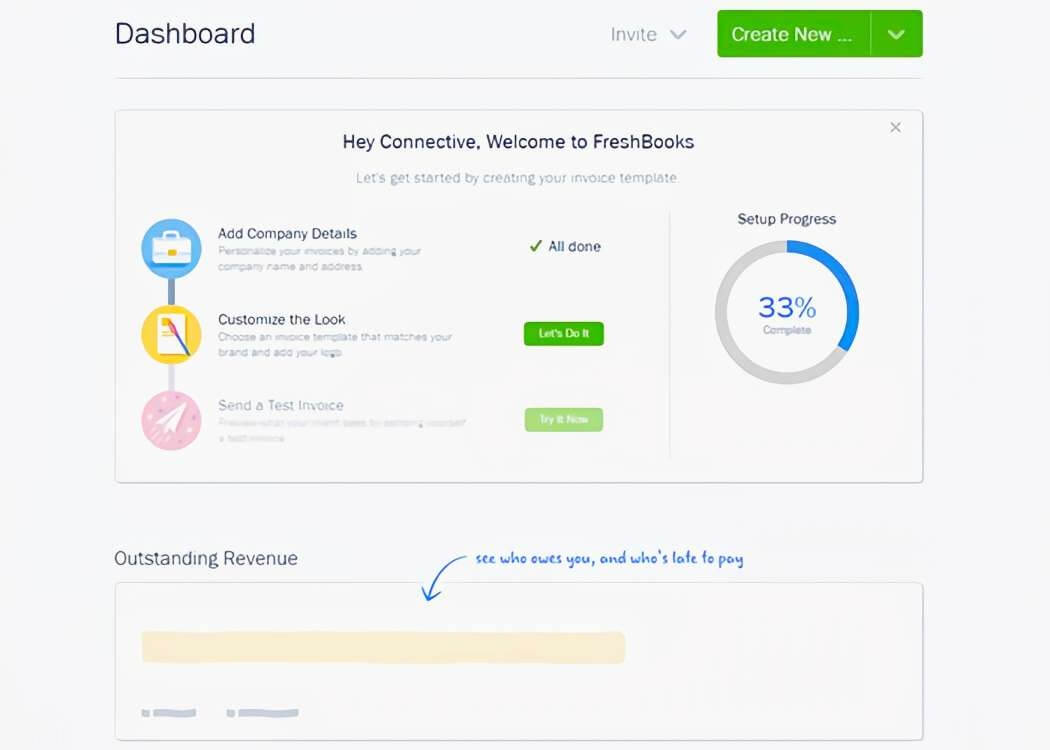

How to get started with FreshBooks

With its user-friendly interface, FreshBooks is easy to learn and use. Here’s everything you need to know to set up a FreshBooks account, generate your first invoice, and receive payment.

Create your FreshBooks account

If you’re just getting started with FreshBooks, you may not need to pay for anything yet. You can use the 30-day free trial to get the hang of how the software works and test all its features. When the free trial ends, you can choose a paid plan that suits your specific needs.

You can sign up for FreshBooks accounts in one of three ways:

With FreshBooks:

- Go to the sign-up page on the FreshBooks website

- Enter your email

- Add a password (at least eight characters)

- Click ‘Get Started’ and answer a few questions about your business; then, you can explore your account

With Apple:

- Go to the sign-up page on the FreshBooks website

- Press the ‘Sign in with Apple’ button

- Enter your Apple ID email before clicking the arrow button

- Enter your Apple ID password and click the arrow button

- Enter your two-factor verification code

- Click Continue to proceed with the Sign in With Apple set up

- Edit the name (optional), then choose between Share My Email or Hide My Email to create your account

- Press Next to be directed to your FreshBooks account to complete your set up

With Google:

- Navigate to the sign-up page on the FreshBooks website

- Press the ‘Sign in With Google’ button

- Enter your Google email before clicking Next

- Enter your Google password and press Next

- Click ‘Allow’ to grant FreshBooks access to your Google Account

- You’ll be directed to your FreshBooks accounts to complete your set up.

Add your first client

Once you create your FreshBooks account, you need to add your first client by providing your client’s name and email address. Note: Be sure you enter the correct email address.

Your client may want to receive the invoice, or they may require you to send it directly to their invoicing department. You can add other details like the company’s email address, but there’s no cause for alarm if you don’t have the information and your client doesn’t provide it right away. Click save and proceed to the next step.

Generate your invoice

After saving your first client’s details, you’ll have several options that you may need to use later. However, press the arrow next to the ‘Create New’ button and choose ‘Invoice.’

The program pre-fills the invoice number and issue date, so you can leave them as-is or modify them. You can then add some details as follows:

- Item: Add a new line and enter the product or service for which you’re billing. FreshBooks limits item names to 50 characters. Once you enter the name, add a description below it with details of the work for which you’re invoicing.

- Rate and hours: If you charge your client on an hourly basis, enter your rate and time in the two columns. If you charge a flat rate per project, you can enter your total charges in the rate column and bill for one hour. For multiple projects’ billing, add another line, and repeat the process above.

- Logo: If you want to include your business logo in the invoice to give it a professional touch, you can insert the logo file directly. Simply drag and drop the file or upload it from your device, so your client receives a more professional-looking invoice.

- Time-tracking: FreshBooks allows you to generate invoices directly from the billable hours you have tracked with the Time Tracking function. Just click “Generate Invoice” and pick the correct hours logged for the client.

Add terms and notes

Adding anything to the terms and notes boxes is optional. However, it’s best if you agree on terms with your clients beforehand. You can use the terms box to add a reminder, and the notes box is an excellent place to add a friendly note to your client, letting them know you enjoyed doing business with them. FreshBooks claims that clients pay 5% quicker if your invoice is polite.

Send your invoice

It’s always important to double-check the details of your invoice before sending it. Once you press send by email, a pop-up will appear, allowing you to review the email content as it will appear to your client. You can edit both sections to ensure your invoice is as professional and personalized as possible.

For clients that don’t use email, FreshBooks allows you to copy a sharable invoice link, allowing for some flexibility.

Receive payment

After sending your invoice successfully, the only task left is to wait for your payment. Here are a few tips to ensure your client makes payment in time:

- Set payment terms: Setting payment terms and including them below your invoice promotes prompt payments. For example, you can add a 10% late fee if the client doesn’t pay within 30 days. When editing an invoice, FreshBooks allows you to set an automatic late fee of either a fixed amount or percentage if the client fails to pay on time.

- Resend the invoice: FreshBooks lets you see if the client has opened and seen your invoice email. If they haven’t, consider resending it.

- Set automatic late payment reminder: FreshBooks allows you to set up to three late payment reminders that auto-send when your client fails to pay within a specified time frame. To set these reminders, go to edit invoice > send reminders > automatically send payment reminders.

It’s worth noting that FreshBooks’ Invoice page provides loads of information about your recent and past invoices. The accounting software supports two other types of transactions:

- Estimates

- Proposals

You can convert both of these transactions to invoices, but a proposal is a far more comprehensive version of an estimate and allows the client to sign upon acceptance. Keep in mind that FreshBooks supports electronic signatures.

A proposal can be several pages long and can include descriptive text and tables. Most FreshBooks alternatives don’t offer such advanced functionalities. Another outstanding functionality is creating retainers that you can use when setting up a long-term business relationship with a client that may require a more sophisticated invoicing.

The pros of FreshBooks accounting software

Most solopreneurs and small business owners choose FreshBooks for its numerous advantages: a user-friendly interface, multiple integrations with other applications, a robust mobile app, and reliable customer service. Let’s explore some of the benefits further:

Well-designed and user-friendly interface

FreshBooks developers designed it with the smaller business owner in mind to efficiently meet small businesses’ needs. It features a well-designed interface that is simple to use. You can easily find various functions while navigating around your dashboard. Even without an accounting background, it won’t take you much time to learn how to use this program.

Compatibility with other programs

If you run an online business, you’ll typically use several different programs. To streamline your operations, you’ll want these programs to communicate with each other, and FreshBooks understands the importance of this.

This accounting software supports integration with more than 200 programs, and some of these are:

- Stripe

- PayPal

- Dropbox

- G Suite

- Acuity

- Gusto

If you aren’t sure if a program you use is compatible with FreshBooks, simply look at their integrations list to find out.

Robust mobile apps

We do virtually everything on our phones in today’s digital age, including our accounting and bookkeeping. FreshBooks mobile app allows you to do your bookkeeping anywhere, anytime. The app also saves you the stress of scanning your receipts for electronic copies. You can simply take pictures of the receipts and store them directly in your app.

Brandable invoice templates

One of the primary reasons for developing FreshBooks was to make it easier for small businesses to invoice clients. FreshBooks invoices are easy to create and send, and they allow you to brand them to your business. Additionally, your clients can also pay you directly from the invoice.

Exceptional customer service

FreshBooks boasts outstanding customer service whenever clients have any issues or queries. The customer support team is knowledgeable and always ready to help. One of the company’s goals is to help business owners succeed in their business, and they understand that having quality financial records is an integral component of that process.

FreshBooks cons

Despite its ability to make invoicing and other accounting tasks easy, FreshBooks has a few setbacks that may drive you to look for other alternatives. Here are some of FreshBooks drawbacks:

- FreshBooks doesn’t have vendor management and inventory tracking, meaning it may not be an excellent choice for businesses that sell products. Nonetheless, it has project management and time-tracking features, making it ideal for service and project-based businesses.

- This software doesn’t offer batch-invoicing shortcuts that would come in handy if you needed to invoice multiple clients for the same service at the same rate.

- FreshBooks has limited templates and fonts to choose from, making its invoice customization more limited than those of its major competitors.

- While the mobile app offers numerous features, it doesn’t allow you to view reports. You always have to use a browser to access your account, which can be inconvenient if you’re on the go.

FreshBooks vs. QuickBooks

FreshBooks and QuickBooks are the two most popular accounting software programs for small business owners, and they’re both excellent options if you’re looking for a reliable cloud-based accounting platform.

Both platforms enable you to streamline accounting, invoicing, payments, and other business operations. However, FreshBooks plans are relatively cheaper than QuickBooks, allowing you to lower your business operation costs.

Let’s compare the pricing of the two platforms:

- FreshBooks plans

- N/A

- Lite: $15/month

- Plus: $25/month

- Premium: $50/month

- Select: custom pricing

- QuickBooks plans

- Self-employed: $10/month

- Simple start: $25/month

- Essentials: $40/month

- Premium: $70/month

- Advanced: $150/month

Another notable benefit of FreshBooks over QuickBooks is the simplicity of the platform. The FreshBooks system is generally more user-friendly and easy to set up, even for those without prior accounting experience.

FreshBooks FAQs

Who owns FreshBooks?

Founded by McDerment in 2003, FreshBooks is a privately held but venture capital-funded company based in Toronto.

What is the use of FreshBooks?

FreshBooks is a bookkeeping software with various accounting features to make it easier for service professionals and self-employed individuals to accomplish accounting tasks.

How does FreshBooks work?

FreshBooks works like other cloud-based accounting software. It stores your information in the cloud, saving you the need to download any programs or files to start working. You only need to log into your account online to access your FreshBooks dashboard.

What is the cost of FreshBooks?

FreshBooks’ pricing starts at $15 per month for the Lite plan, which supports up to five active clients. The Plus plan starts at $25 per month while the Premium plan goes for $50 per month. If none of these plans suits your needs, you can opt for the more advanced package with custom pricing, known as FreshBooks Select, that can support at least 500 active clients.

Does FreshBooks integrate with QuickBooks?

No more wasting hours inputting data manually! FreshBooks will automatically add a purchase invoice in Quickbooks Online when an expense is created. With versions of OneSaas for both accounting and invoicing, it’s never been easier to stay on top of your finances with minimal effort – all you have to do is log into the program once daily.

Is FreshBooks better than QuickBooks?

If your primary concern is to track time, services, and non-depreciating items, then FreshBooks is your best bet. FreshBooks’ main goal is to make invoices for professional services easier and more accessible.

On the other hand, QuickBooks is a fully-fledged accounting software with more complicated functionalities and a steeper learning curve. It’s a better choice if you want to perform more complex accounting tasks.

Can I track mileage with FreshBooks?

You can track mileage with FreshBooks. To do that, however, you’ll need to integrate the system with Everlance. Everlance is a mileage tracking application that syncs seamlessly with FreshBooks, and it comes at an extra cost.

What is FreshBooks Classic?

FreshBooks Classic refers to the FreshBooks version before 2017. FreshBooks offers support to customers who opted to stick with FreshBooks Classic instead of upgrading to the more advanced accounting software. If you’re a new customer, however, you can’t sign up for FreshBooks Classic.

How do I accept online payments with Stripe-powered FreshBooks payments?

To start receiving payments by Bank Transfer and Credit Card on your invoices, you can activate FreshBooks Payments powered by Stripe (International). If you’re in Canada or the USA, you can use both Stripe and FreshBooks Payments powered by WePay instead.

It’s worth noting that FreshBooks doesn’t support Braintree and Authorize.Net. With Stripe, your clients will be able to make invoice payments with a credit card, and money will be credited to your bank account automatically.

Linking your FreshBooks account with Stripe is a simple process that takes less than ten minutes. You’ll need to log in to an existing Stripe account or create a free Stripe account.

Will I pay transaction fees?

You don’t need to pay any monthly or set up fee to use FreshBooks Payments. However, most cards charge a transaction fee of 2.9% plus 30 cents per transaction, taken directly from your deposit.

What should I do if I have an issue with my account or payment?

If you have any problems with your FreshBooks account or the online payment process, don’t hesitate to contact the FreshBooks customer team by phone, email, or live chat. You can also find valuable information on the company’s website.

How to choose the best accounting software for your business

With so many options available, choosing the right accounting software for your business can be challenging. Here are some factors to consider to help you find the accounting software that will best serve your business needs.

Your accounting skills

When you’re just getting started with your business, you may not have substantial financial or accounting skills. However, it’s essential to be on top of your business’ accounting, so you’ll need to find accounting software that suits your needs and matches your capabilities.

While the software will make accounting more manageable for you, you’ll still need to have a basic understanding of your finances and what you want to accomplish with the software. FreshBooks is one of the most user-friendly accounting software that even those without accounting experience can use.

Cloud-based applications

With cloud computing taking center stage in the modern business world, you shouldn’t ignore the many cloud-based accounting systems available. Cloud applications can benefit your business in many ways. You can access them from any location with a stable internet connection, and you don’t have to purchase servers or licenses to run them.

You also don’t need to employ an IT technician to keep the application up to date, as the installation of patches and upgrades occurs on the server end. Additionally, you can access cloud-based software using a wide range of devices, including laptops, smartphones, or tablets.

Another great advantage of cloud applications is that your information is stored securely at a data center far from your business’ location, ensuring its safety in case of any destructive event.

Your budget

There’s a wide selection of accounting software to suit all budgets, and you can even find free accounting applications for download. However, you need to consider if the cheaper options will meet your business’ needs.

You might want to consider choosing more expensive accounting software and minimize common accounting errors that may result in wasted time and money.

Accounting software applications like FreshBooks have different pricing packages, so you can choose a plan that best suits your budget.

The features you need

You’ll have an easier time selecting accounting software when you understand the features you need for your business operations. If you’re a small business, here are some of the features you might need in accounting software:

- Budgeting

- Invoicing

- Sales tracking

- Estimates

- Inventory management

- Payroll processing

- Business tax reporting

- Customer contacts management

- Merchant account support to accept credit card payments

Projects and time tracking

If you run a business that undertakes projects on behalf of clients, it’s best to choose an accounting application that can handle project-based billing. You want to bill clients based on the hours spent on the project tasks or set a fixed rate for each project.

If you bill on an hourly basis, find an application that allows you to track the time spent on specific tasks and can convert the timesheets into invoices. The system should allow you to approve time records before generating invoices from them to prevent inaccurate billing.

Bank reconciliation

Bank reconciliation is an integral component of your bookkeeping. Find an accounting application that works with your bank and can fetch your bank statements automatically. The software should also allow you to define custom criteria and bank rules that automatically classify and match your imported bank transactions. With this function, you’ll be able to reconcile your accounts quickly, keeping your business audit-ready.

Data security

Data security is one of the most important factors to consider when shopping for an accounting software application. Find out how the software application stores its data. Most reputable cloud-based applications like FreshBooks have their own servers for storing data. Before you pick an application, ask the company about the steps they’ve taken to ensure your data security.

Ease of use

If you’re running a start-up, you may not be well-versed with accounting processes. As a business owner, it’s crucial that you understand and can access your financial records. It’s also essential to have an easy-to-learn accounting system for your team.

Use an application with features that are easy for all of your employees to use. You want an application with a simple, well-designed interface that is not crowded with unnecessary features. With a clean interface, you can easily focus on essential tasks and minimize the learning curve.

Add-on features

As the name suggests, add-on features provide functionality to accounting software. You can find a feature that allows you to access the application remotely or accept payments online. Other features can enable you to integrate the accounting application with your eCommerce system.

Some add-ons make your accounting software compatible with tax applications. Before you decide on any accounting software, find out what add-ons it supports.

Customer support

Many business owners don’t think about the customer support they may need after purchasing an accounting software application. No matter the quality and reliability of the software you choose, chances are you’ll need support at some point.

You might have chosen the best software for your needs, but it will be useless if you can’t find someone to guide you on how to use it properly. With some programs, you’ll need to pay extra for post-purchase support.

Before you decide on any program, determine the quality and reliability of their support. Try messaging or calling the support team and see how long it takes you to get a response. Evaluate the company’s support based on how quickly they respond and the quality of the feedback.

Final thought

After this comprehensive FreshBooks review, you can now decide if it’s the right accounting software for your business. We’ve discussed everything you need to know to make an informed decision, including FreshBooks features, plans, pricing, as well as its pros and cons. We’ve also looked at some of the essential factors to consider when choosing an accounting software application.

Overall, FreshBooks offers a well-rounded, intuitive, and impressive double-entry accounting experience with robust capabilities and user-friendliness. It supports invoices, estimates, expense and time-time tracking, and monitors the progress of projects. It’s an ideal accounting solution for small businesses, solopreneurs, and freelancers.

If you aren’t sure if FreshBooks is right for your business, you can take advantage of the 30-day trial with no credit required to see how it works. By testing all the FreshBooks features on your business, you’ll be able to decide if it will meet your businesses’ accounting needs.