Over the last few weeks, I’ve been reading endless articles and watching hours and hours of videos, obsessed with trying to figure out the best business credit card strategy for my business. This is how my brain works. It needs something to fixate on something. It’s my superpower but can also annoy the hell out of those close to me.

As a preface, please keep in my that my credit card strategy may not be perfect for you. As I’ll go on to discuss, there’s many elements that went into my decision, and some of those elements will be drastically different from company to company.

After hours of deliberation, carefully considering all of the factors involved, I finally got what I had been looking for: the perfect business credit card strategy for my business. That is what I want to show you today.

My Business Credit Card Strategy I developed that will net me well over $12k over the next year in cash back, miles, and all kinds of extra perks just by tweaking how I pay expenses. Let’s get to it.

Setting business credit card goals

Before I began my research of business credit cards, I had to make sure that I knew exactly what I was looking for in my ideal credit card strategy. I did this by setting four goals.

- The credit cards MUST be an actual business credit card. It needs to build business credit and not intermingle with my personal expenses (or else my accountant may kill me).

- The credit cards should have minimal fees involved. However, I don’t mind paying yearly fees as long as the math works out, and I’m only spending money on things that I would normally spend regardless.

- I want to use as few credit cards as possible. This is just to make things simpler for me in the long run.

- I want to maximize the amount of in cashback, travel miles, and useful perks. Sign-up bonuses are also a plus but not a necessity.

Finally, interest rates are completely irrelevant to me. I always pay in full, so it will never be an issue. However, I needed to establish one more thing before I truly began looking through all of the business credit cards there were to offer.

Matching expenses to the right credit cards

Before I (and you) begin researching credit cards, it’s crucial to assess your expenses. After all, you may accrue tons of profit, but not knowing how you spend it could screw everything up. Otherwise, how would you know whether or not a card is actually good for your business?

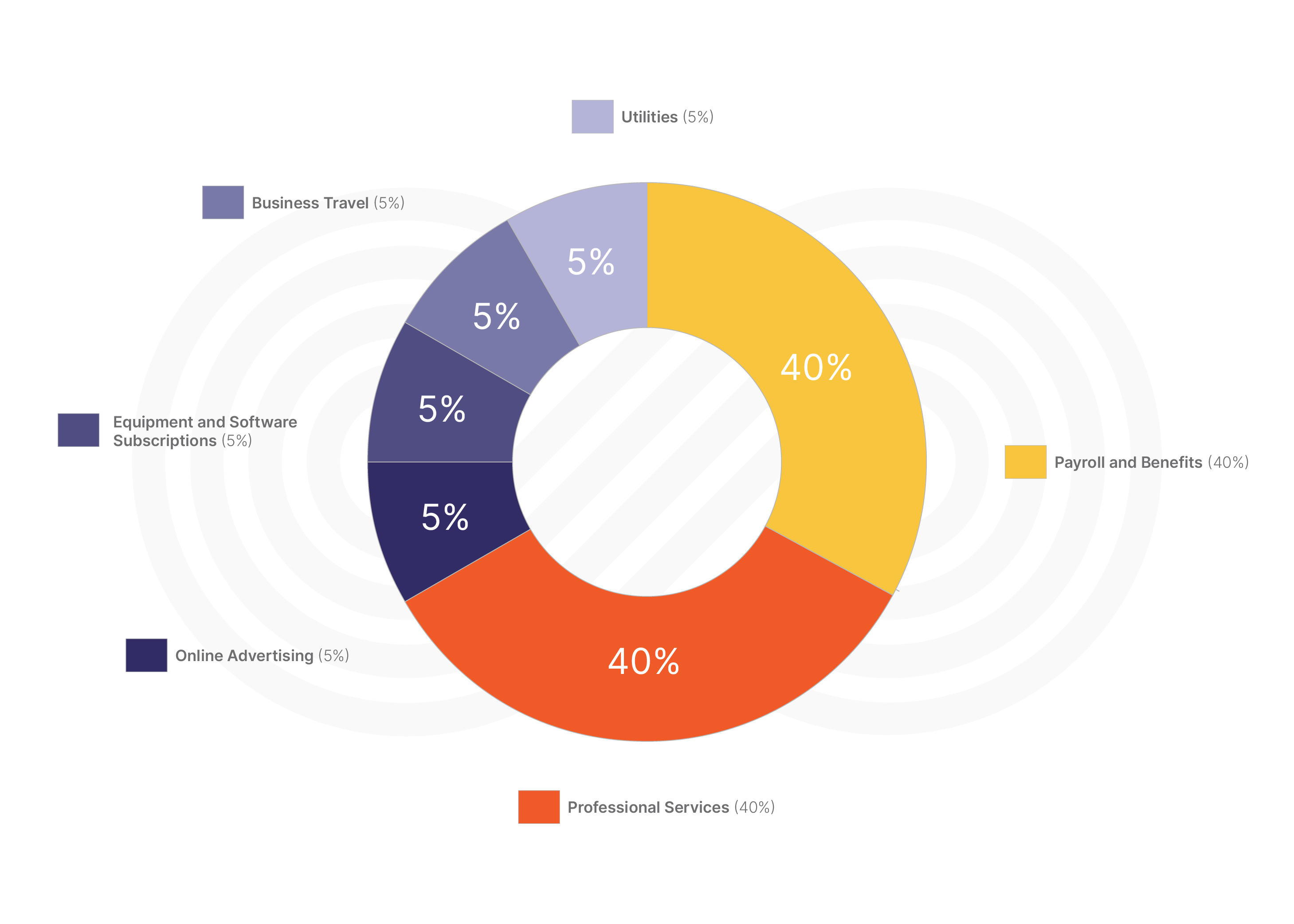

I pulled our P&L and began to take notes. Here’s a compressed breakdown of where all of our hard-earned money goes.

Payroll and Benefits account for roughly 40% of all spending. Unfortunately, this section cannot be paid with a credit card, so we can disregard it for the purposes of this project.

Another 40% goes to Professional Services like subcontractors, accountants, lawyers, writers, link builders, and such. Almost all of these can be paid with a credit card.

Finally, the last 20% is split up pretty evenly between…

- 5% – Online advertising

- 5% – Equipment and software subscriptions

- 5% – Business travel

- 5% – Utilities

Thankfully, all these categories can be managed with a card. Now, with all of these factors in mind, I was finally able to delve into the great unknown and begin my research.

The top 7 business credit card contenders

I’m sure you could easily imagine what it was like to do research into this topic. After loads of blog articles and hours of video content, I short-listed the cards I felt I should dig deeper into. I narrowed down the list, disregarding hotel cards and overly specific options that didn’t align with my requirements.

And there I was, down to just the final 7. The cards were the following:

- Chase Ink Business Premier℠ Credit Card

- Chase Ink Business Preferred® Credit Card

- The Business Platinum Card® from American Express

- American Express® Business Gold Card

- American Express Blue Business Cash™ Card

- Bank of America® Business Advantage Customized Cash Rewards Mastercard®

- Capital One Spark Cash Plus

To summarize, I had 2 Chase cards, 3 Amex cards, a Bank of America card, and one card from Capital One. Talk about diversity!

All of these cards have their pros and cons, and all could work for most businesses depending on needs. One could start by looking at these seven and choose from there, and it would be hard to make a wrong decision. Now it’s time to go into the details of each of these cards. Here we go!

(By the way, if you want to see how I curated this list, check at the end of the article where I will leave my sources)

The American Express Blue Business Cash™ Card

Welcome Bonus: $250 after spending $3,000 in 3 months.

Annual Fee: $0

Benefits:

- 2% cash back on all purchases up to $50k per year.

- 1% cash back after surpassing $50k per year.

- Access to Expanded Buying Power.

This card is pretty impressive. It offers a 2% cash back without any spending categories to track which is always nice for ease of use. Additionally, the welcome bonus is easy to meet for basically any business, no matter how small. This expanded buying power can provide a bit of peace of mind for potential needs.

However, despite these benefits, I decided not to use this card. While it offers a solid 2% cash back on the first $50k with no annual fee, we’ll easily surpass that threshold, and there are more suitable cards available.

That being said, the easy-to-meet welcome bonus might be enough for me to consider opening this card. But for now, this card is off the list.

The Business Platinum Card® from American Express

Welcome Bonus: 120,000 points after spending $15,000 in 3 months.

Annual Fee: $695

Benefits:

- 5X points on flights & prepaid hotels

- Global Lounge Collection

- $200 Airline Fee Credit

- Free Global Entry or TSA PreCheck

- Status upgrades w/ Marriott & Hilton

Firstly, that welcome bonus though? That is equivalent to $1,200, which covers almost two years of the annual fee! With the $200 airline fee credit, it covers two years plus a little more.

If you do a lot of business travel, this card would be mad worth it. It offers 5x points on flights and hotels, exceptional airport lounges, and instant gold status upgrades with Marriott and Hilton hotels. However, it is for this reason that I decided not to use this card. We just don’t travel enough to justify that yearly fee.

If our business’s travel needs ever pick up, then maybe I’ll reconsider using this card, but for now it’s off the list.

The American Express Business Gold Card

Welcome Bonus: 70,000 points after spending $10k in 3 months

Annual Fee: $295

Benefits:

- 4X points in the top 2 select categories based on monthly spending.

- No Preset Spending Limit

- No Foreign Transaction Fees

- Additional perks

This card’s 4x points is unbelievably enticing. This is especially considering the fact that the approved categories contain common spending zones such as travel, computer equipment, gas, and restaurants, making this card very easy to take advantage of. It’s also one of only two cards I could find that specifically reward online advertising, which can be huge for a marketing agency like us.

That being said, I decided not to use this card. When I gave American Express a call to inquire further about the categories for 4x points, I figured out that the way charges from the businesses we pay are reported might not fall neatly into the categories that would actually help us.

We’ll definitely consider opening this card when we scale up online advertising or when we need the extra 4% for hardware upgrades. But for now, it’s off the list.

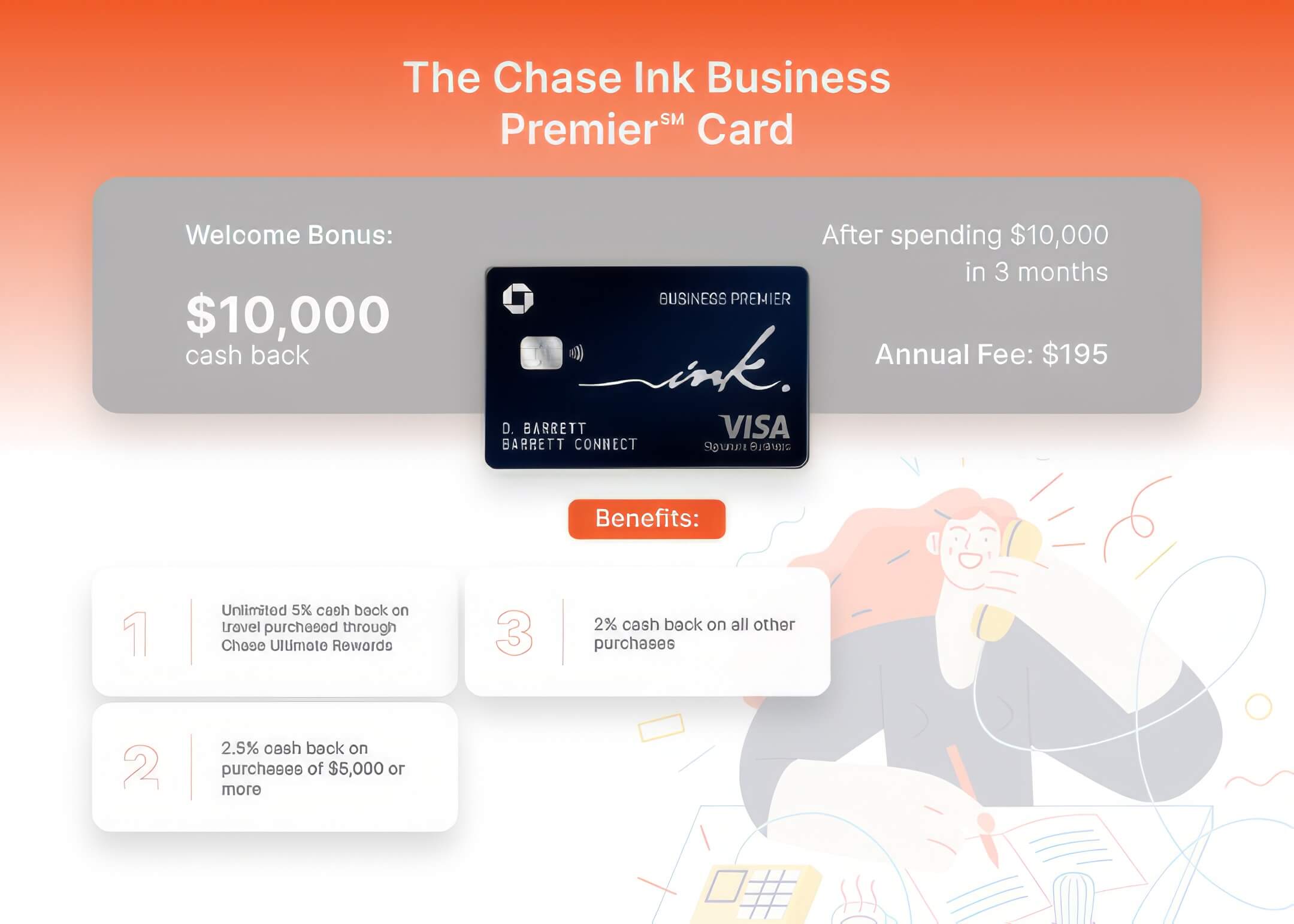

The Chase Ink Business Premier℠ Card

Welcome Bonus: $1,000 cash back after spending $10,000 in 3 months

Annual Fee: $195

Benefits:

- Unlimited 5% cash back on travel purchased through Chase Ultimate Rewards

- 2.5% cash back on purchases of $5,000 or more.

- 2% cash back on all other purchases

Wow, that welcome bonus is great; it covers 5 years in fees! Not only is the unlimited 5% cash back on travel exceptional, but also that 2.5% cash back on purchases of $5,000 or more would be perfect for our company! Finally, 2% cash back on all other purchases is definitely not something to scoff at either.

Despite all of my talk about how great this credit card is, I reluctantly decided to not use it. The math just didn’t work out when compared to the other options. However, if our monthly purchases exceeding $5,000 increase even slightly, we’ll reconsider getting this card.

Honestly, if you talk to me in 6 months, you’ll probably end up seeing this card as part of our roster, but for now, it’s off the table.

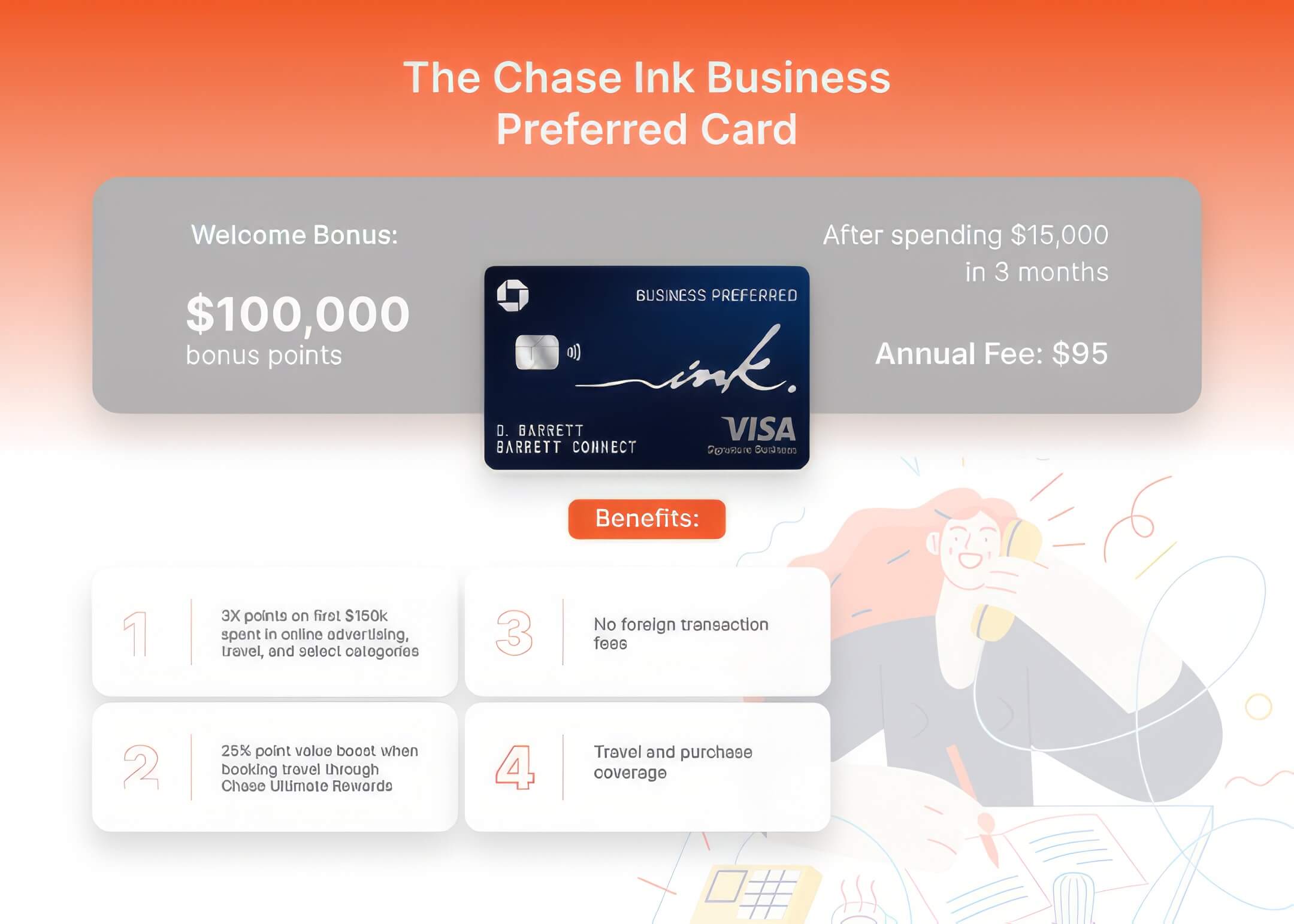

The Chase Ink Business Preferred Card

Welcome Bonus: 100,000 bonus points after spending $15,000 in 3 months

Annual Fee: $95

Benefits:

- 3X points on first $150k spent in online advertising, travel, and select categories.

- 25% point value boost when booking travel through Chase Ultimate Rewards

- No foreign transaction fees

- Travel and purchase coverage

Wow, that welcome bonus is mad good with a value of either $1,000 flat or $1,250 if you spend it on their travel system. The annual fee is pretty manageable, and the 3x point opportunities are plentiful and useful.

This will be a great card for us, and as such, I decided to use this card in our strategy. This is because we have some travel coming up and this card can help us out there. Not to mention that redeeming the points towards travel will make the points even more valuable as well as the fact we spend on online advertising quite often, to put it lightly.

There is one caveat, though. If and when our online advertising spend starts to scale up, we will need to augment this card with the Amex business gold card, as the 3x rewards are capped at 150k/yr. For now, though, this card is part of our strategy.

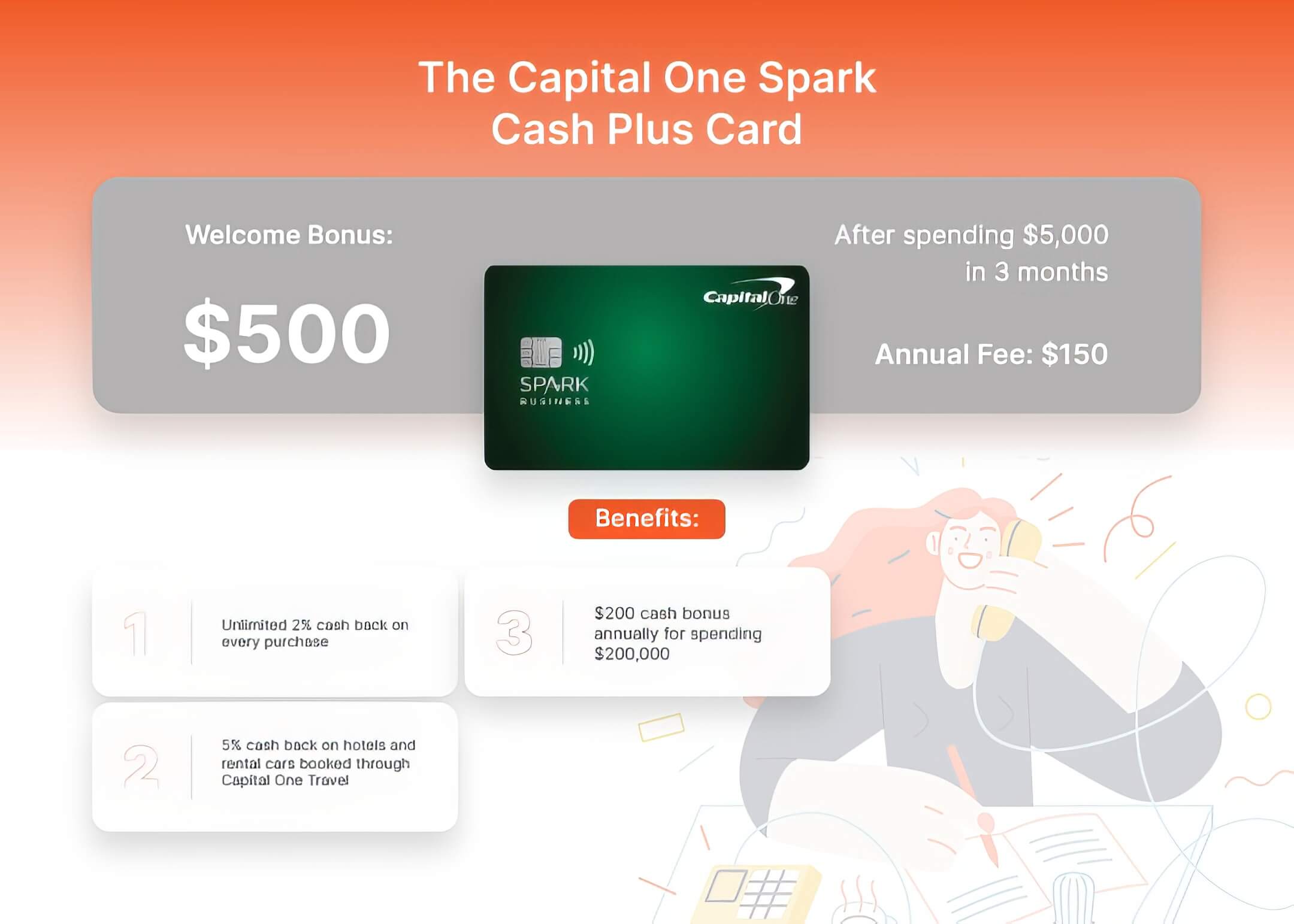

The Capital One Spark Cash Plus Card

Welcome Bonus: $500 after spending $5,000 in 3 months, and $500 after spending $50,000 in 6 months

Annual Fee: $150

Benefits:

- Unlimited 2% cash back on every purchase

- 5% cash back on hotels and rental cars booked through Capital One Travel

- $200 cash bonus annually for spending $200,000

The welcome bonus here is decent, although the barrier to entry to fully take advantage of it is a bit steeper than others. However, the 5% back on hotels and rental cars will certainly come in handy, and the blanket 2% is incredible.

We decided to use this card as the designated go-to for “Everything Else,” netting us a blanket of 2% since our spending doesn’t fit neatly into categories you can take advantage of with other cards. We will additionally spend enough each year to get the $200 cash bonus which will more than offset the annual fee, and we’ll make use of the hotel and car rental perks as well.

This card definitely will be one of the staples of our credit card strategy for a while. It’s benefits are impossible to ignore and are helpful in literally every circumstance.

The Bank of America Business Advantage Customized Cash Rewards Mastercard®

Welcome Bonus: $300 statement credit after spending $3,000 in 3 months

Annual Fee: $0

Benefits:

- 3% cash back in the category of your choice (on the first $50k in combined choice category/dining purchases each year)

- No annual fee

- Up to 50% to 75% more rewards with a Bank of America business checking account and qualifying balance

Ignoring the mouthful that is this card’s name, this card is pretty great. No annual fees and a welcome bonus that’s easy to hit? What’s not to love!

Obviously, I decided to incorporate this one into our credit card strategy. Although the categories for the 3% cashback may not always line up with what we’re spending, I can easily choose the most suitable one and change it as needed.

On top of that, if we get a Bank of America checking account with a balance of 50k to 100k+, we can take advantage of the Preferred Rewards for Business program, which boosts rewards up to 5.25% cash back. If we go that direction, this card could become even more beneficial.

I have no doubt that this card will remain a staple of our credit card strategy. That 5.25% cash back is simply too enticing!

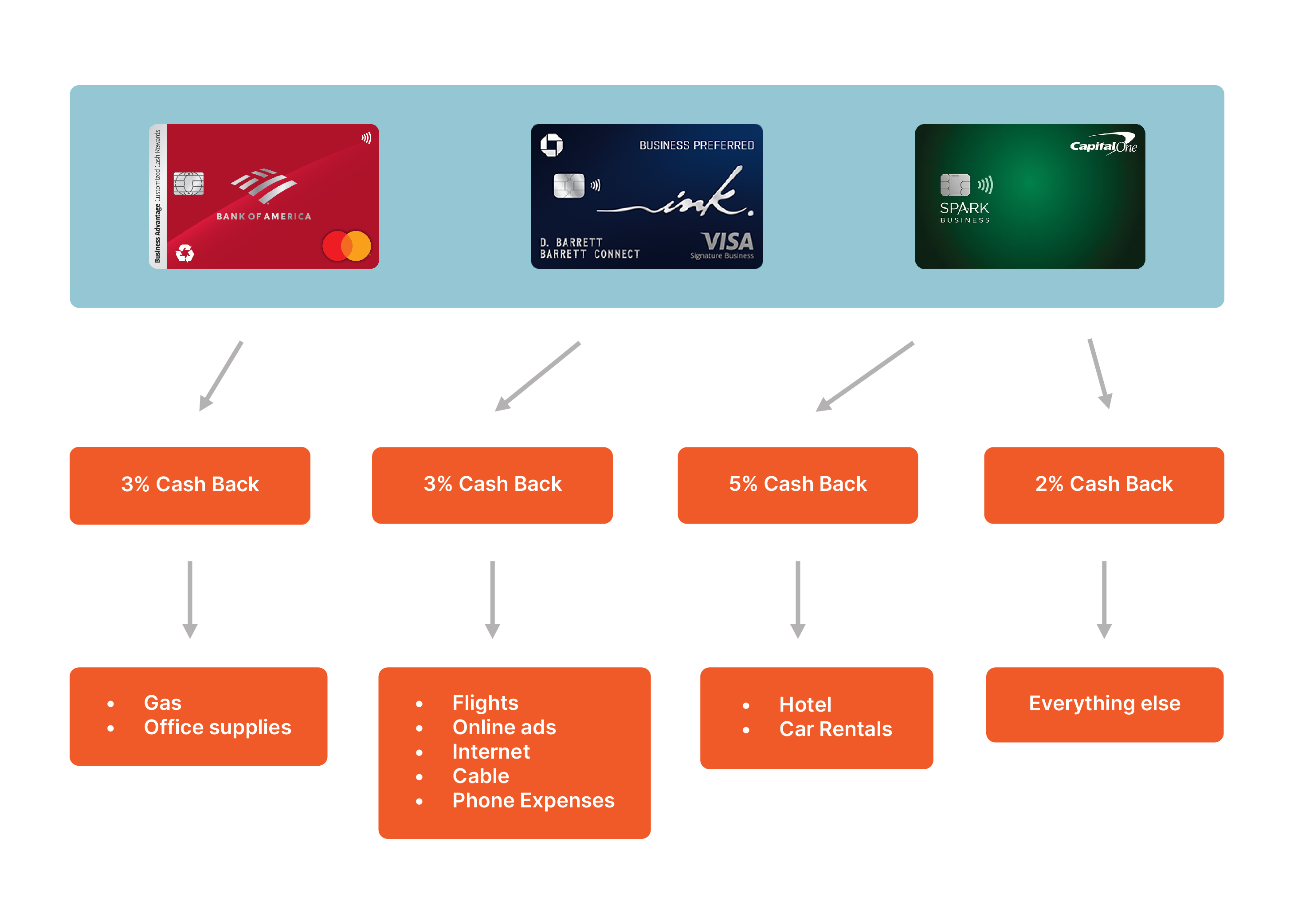

My 3-card business credit card strategy

Remember, this plan may not work for you, and that’s OK! Just take a look at the cards I researched and pick and choose what suits you. Now, without further ado, this is my small business credit card strategy.

- Bank of America Business Advantage Customized Cash Rewards Mastercard® for 3% cash back on gas and select spending categories like office supplies.

- Chase Ink Business Preferred for 3% cash back on flights, online ads, and internet/cable/phone expenses.

- Capital One Spark Cash Plus for 5% cash back on hotels and car rentals and 2% on everything else.

Once you establish a system like this, it requires minimal effort to upkeep, but it can have a significant impact. In my case, it will result in $10,000 to $15,000 back, depending on my yearly expenses. I think this amount of money alone should convince any small business owner to consider developing their own credit card strategy,

My closing thoughts

I hope this article was helpful to you, whether you’re just starting your small business or are experienced and trying to find ways to make extra dough. Hopefully you are now attuned to the idea of creating your own business credit card strategy, have a decent starting point, and maybe even all you need to begin doing it yourself.

If you have suggestions to improve this strategy or would like to know about my personal credit card strategy, contact us by filling out our contact form.

Credit card research sources

These are the articles I referenced…

- https://www.forbes.com/advisor/credit-cards/best/business/

- https://www.nerdwallet.com/best/credit-cards/small-business

- https://www.bankrate.com/finance/credit-cards/business/

- https://money.usnews.com/credit-cards/business

- https://thepointsguy.com/credit-cards/business/

- https://www.cnn.com/cnn-underscored/money/best-business-credit-cards

- https://wallethub.com/best-business-credit-cards

- https://www.creditkarma.com/credit-cards/business-credit-cards

- https://financebuzz.com/best-credit-cards-for-google-ads-spend

…and these awesome creators made some super helpful videos.

- Dave Hanson / Hey there, Dave here.

- Brian Jung

- John Liang

- Ask Sebby Business