Understanding customer acquisition cost (CAC) is crucial for any business looking to improve profitability and strategy. It’s the financial metric that reveals the investment required to gain a new customer. But why does this matter?

Knowing your CAC is key to understanding the return on your marketing investments and ensuring long-term business growth. This article will guide you through the essentials of CAC, equip you with the knowledge to calculate it accurately, and explore strategies to optimize it for the health of your business.

If you’re lacking in time…

Customer acquisition cost (CAC) is critical for assessing the return on investment in marketing strategies, weighed against customer lifetime value (CLV) to ensure profitability. You can calculate CAC by summing up the costs of sales and marketing and dividing by the number of new customers. In conjunction with other business metrics like CLV and LTV, you can derive valuable insights crucial for strategic decision-making.

Reducing CAC involves refining marketing efforts through strategies like A/B testing and technological solutions like AI and CRM systems, as well as maintaining sales and marketing alignment.

Decoding customer acquisition cost (CAC)

Consider CAC as a means to pinpoint how much a business invests to persuade a customer to purchase its products or services. CAC plays a significant role in not only fostering growth in terms of numbers but also in a profitable manner. But wait, there’s more to the story. Enter, Customer Lifetime Value (CLV). CLV is like the other side of the coin, shedding light on the total revenue a business can reasonably expect from a single customer account. Together, CAC and CLV give businesses key insights into the effectiveness of their strategy and profitability.

The interconnection between CAC and CLV forms a delicate equilibrium that influences the profitability and sales efficiency of a business. It’s like a business’s pulse, revealing how cost-effective it is to acquire new customers and about how much money is made from any given customer acquisition. How can a business avoid overspending? This is where keeping track of marketing expenditures becomes instrumental in comprehending and enhancing CAC.

However, CAC isn’t solely about sales and marketing expenses. It’s like a pie, with slices representing various costs, such as:

- market research

- data analysis

- new client discounts

- referral discounts

Imagine overspending on acquiring customers and then scrambling to make a profit. It’s like flying against the wind, making it harder for businesses to reach their destination profitability.

Why is CAC So important to businesses?

So, we’ve decoded CAC, but why is it so important? Think of it as a flashlight, illuminating the return on investment from sales and marketing efforts. It’s like a compass, guiding businesses on where to invest their resources and how to plan their marketing campaigns. But what happens when the compass is off?

A high CAC can be like a leak in a boat, draining resources and making it tough for the business to sail toward profitability, especially if the CAC is higher than the customer lifetime value (CLV).

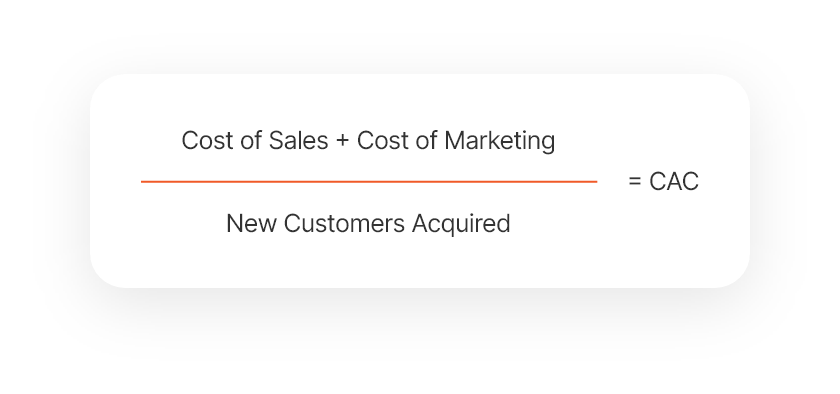

The formula to calculate customer acquisition cost

Having understood the significance of CAC, let’s dissect the formula. It’s quite simple, really. Just add up your sales and marketing costs, then divide that by the number of new customers you have acquired. This formula includes all sales and marketing expenses needed to gain customers and the number of customers acquired.

(WHOEVER IS POSTING THIS, WE SHOULD HAVE SOME KIND OF GRAPHIC HERE TO ILLUSTRATE THE FORMULA)

Here’s an instance to exemplify the application of the formula. Suppose a company spends $36,000 on sales and marketing to acquire 1000 customers. The CAC would be calculated as $36,000 / 1000, resulting in a CAC of $36. It’s all about making sure the math adds up to a profitable outcome.

Diving deeper into the components of the CAC equation

Let’s scrutinize the constituents of the CAC equation. They’re like the ingredients in a recipe, each contributing to the overall flavor. The three key ingredients are Cost of Sales, Cost of Marketing, and New Customers Acquired. Each plays a significant role in shaping the final CAC.

Cost of sales

Cost of Sales is like the flour in a cake recipe, a fundamental ingredient. It includes things like advertising expenses, marketer salaries, and salesperson costs. These costs are accumulated during the sales process and contribute significantly to the sales and marketing cost component of CAC.

Keeping track of these costs is akin to observing the dough and ensuring it rises optimally.

Cost of marketing

Now, let’s turn our attention to the Cost of Marketing, also known as marketing spend. It’s like the sugar in our cake recipe, sweetening the deal for potential customers. It encompasses:

- Creative costs for content creation

- Publishing costs like TV air time and paid social media ads

- Salaries of employees managing and monitoring content distribution and performance.

Moreover, the technology and tools utilized by marketing and sales teams also contribute to the cost. Like the baking powder in our cake recipe, these elements help the business rise above the competition.

Is your marketing campaign paying off? The answer lies in calculating the revenue generated by a campaign divided by the amount of money spent on that campaign. This gives you an idea of the return on investment and how cost-effective your marketing efforts are.

New customers acquired

The final element in our CAC calculation is the number of New Customers Acquired. It’s vital to select a typical customer acquisition cycle as your time period. Too broad, like over 5 years, or too narrow, like less than 1 month, can skew your CAC calculation.

Most businesses opt for periods like the past month, quarter, or year.

How to calculate CAC: Step-by-step guide

Having grasped the components, let’s follow a step-by-step guide to calculate CAC using the customer acquisition cost formula. When calculating customer acquisition cost, don’t forget to use the formula: CAC = (Cost of Sales + Cost of Marketing) / New Customers Acquired. This equation helps determine the cost of acquiring each new customer.

Let’s put this into action with an example. If a business spent $100,000 on marketing and sales and acquired 500 new customers, the CAC would be $100,000 (total marketing and sales expenses) / 500 (new customers acquired) = $200 per customer.

And that’s how the CAC works in practice.

Understanding the interplay of CLV with CAC

Understanding CLV’s impact on CAC can help businesses optimize their marketing strategies for better CAC outcomes. CLV and CAC are like two sides of the same coin. They work together to provide a clear picture of a business’s profitability and efficiency in acquiring customers.

In different industries, CLV and CAC play a crucial role in determining how successful a business can be. Factors like customer satisfaction and loyalty can significantly impact these metrics, helping shape strategies that keep a business profitable and growing.

A good rule of thumb for a successful business strategy is to aim for a CLV to CAC ratio of around 3:1. This means that the value you get from a customer should be about three times the cost of acquiring them.

Benchmarking your CAC against industry standards

Similar to athletes comparing their performance against average performances in their divisions, businesses should evaluate their CAC against industry averages. This comparison provides insight into your standing in the industry and identifies areas for improvement.

Benchmarking your CAC can guide better business decisions by providing a sense of how your CAC measures up to others in your industry. It can also reveal areas for improvement and help you set achievable goals. However, it’s important to remember that the first number you see online may not be the perfect example for your specific business or industry.

Key strategies to optimize your CAC

Now that we’ve comprehended CAC and its components, let’s delve into some strategies to optimize it. Think of these strategies as tools in your toolbox, ready to be deployed to refine marketing efforts and leverage technology.

Refining marketing efforts for better CAC outcomes

One of the ways to improve CAC outcomes is by refining marketing efforts. A/B testing is a popular method used by marketers to determine which strategies work better, thereby improving conversion rates and enhancing user experiences.

By figuring out which content gets the best results, A/B testing allows you to:

- Personalize marketing to fit what your audience likes and wants

- Validate marketing hypotheses

- Keep your business competitive through data-driven decisions.

Leveraging technology to streamline acquisition costs

Another effective strategy to optimize CAC is leveraging technology. Technology like AI and marketing automation can boost conversion rates, save time, provide personalized experiences, and maximize efficiency.

CRM software and automation technology can make marketing strategies and operations more efficient, thereby reducing the cost of acquiring new customers. Additionally, data analytics can help uncover potential savings, make smarter decisions, and strategically select the best sourcing and suppliers to keep costs down.

Examples of CAC in action

Let’s apply all these concepts to some real-world examples. Imagine a real estate company that spends $25,000 on marketing and $10,000 on sales and acquires 70 new customers. In this case, the CAC would be $500. When the CAC is high, it means the company is spending a lot to bring in customers, affecting their profitability.

However, it’s important for companies to ensure they cover all expenses related to acquiring customers when calculating their CAC. This can give a more accurate picture of their costs. Different industries also have their own methods for calculating CAC, where they divide their marketing and sales expenses by the number of customers acquired.

Navigating CAC for different business models

Depending on the business model and industry, the calculation and interpretation of customer acquisition costs can differ. In B2B sales, for example, the customer acquisition costs are usually higher than in B2C sales. This is because B2B customers often pay higher prices, thus justifying the higher acquisition costs.

For a B2B SaaS company, the average customer acquisition cost is $239. In a subscription-based business, good customer acquisition costs help determine how well the business is spending its money on getting new customers. To better understand this metric, it’s helpful to look at customer acquisition cost examples from various industries.

For businesses adopting a freemium model, cutting costs, saving on advertising and engagement, and providing consistent value can have a positive effect on retention and customer satisfaction, which in turn lowers the CAC.

The role of sales and marketing alignment in reducing CAC

Aligning sales and marketing efforts is one of the essential strategies to reduce CAC. This alignment is like a well-oiled machine, ensuring that the leads transition seamlessly from marketing to sales, thereby bringing in as much revenue as possible.

When sales and marketing are aligned, they ensure that the leads they work with are of high quality, increasing the likelihood of converting them into customers. Some typical strategies involve:

- Better communication and teamwork between the teams

- Setting mutual goals

- Establishing a strong channel-partner framework

- Using technology to streamline operations and uncover hidden trends.

Advanced techniques for analyzing and reducing CAC

Apart from the basics, there exist advanced techniques that can aid in analyzing and reducing CAC. Techniques like time series analysis and advanced analytics features in tools like Power BI can help businesses predict and forecast future CAC.

Machine learning uses algorithms to analyze big data, find patterns, provide insights, and offer predictive analytics to optimize CAC. Customer retention programs and churn analysis focus on preventing customer turnover, retaining more customers, and lessening the constant need to invest in new customer acquisition.

Maximizing customer acquisition through digital transformation

Digital transformation paves the way for:

- Maximizing customer acquisition

- Reducing CAC

- Pinpointing audience based on demographics, interests, and behaviors

- Improving targeting

By reaching more of the right people without wasting resources, businesses can cut down on wasted ad spend and achieve better returns. However, the digital transformation budget can vary based on where the firm is located due to different cost structures, impacting the overall expenses.

Building stronger customer relationships to lower CAC

Fortifying customer relationships can significantly contribute to lowering CAC. When customers are happier and stick around, it can help bring down the cost of acquiring customers, especially when acquiring new ones.

Loyalty programs and customer satisfaction can have a big impact on CAC. They keep existing customers engaged and lower the need for costly new customer acquisition efforts. Using customer relationship management software can also aid in building better relationships with customers, thereby reducing CAC.

Monitoring CAC over time for sustained success

Periodically monitoring CAC is akin to taking regular health check-ups. It ensures long-term success and aids in the timely identification of issues.

Businesses should keep an eye on the following metrics:

- Customer retention

- Customer lifetime value

- Average purchase price

- LTV:CAC ratio

This vigilance can provide valuable insights into customer trends and business success. Most businesses tend to check their CAC either every quarter or once a year to ensure things are going well.

Summary

In conclusion, understanding and monitoring Customer Acquisition Cost (CAC) is a crucial factor in driving business growth and profitability. From decoding CAC to leveraging technology to optimize it, every aspect plays a pivotal role in shaping a business’s success. So, keep an eye on your CAC, align your sales and marketing efforts, build strong customer relationships, and let your business sail smoothly toward profitability.

Frequently asked questions

What is acquiring customer cost?

Acquiring customer cost, or CAC, is the total cost of sales and marketing efforts, along with any necessary property or equipment, needed to convince a customer to buy a product or service. It’s an important business metric to measure how much an organization spends to acquire new customers.

What is a good CAC?

A good customer acquisition cost is one that is lower than your customer lifetime value, ideally about 3 times lower. For example, if your customer lifetime value is $15, a customer acquisition cost of $5 or less is considered pretty good.

What is an example of acquisition cost?

Acquisition cost can refer to the cost of acquiring new customers, including expenses like marketing, sales, salaries, and overhead costs. For example, if a company spent $15,000 to acquire new customers and had 1000 purchases, the acquisition cost would be $15.

What is the difference between CPA and CAC?

The main difference between CPA and CAC is that CPA measures the cost of acquiring prospects who are not yet customers, while CAC measures the cost of acquiring paying customers. In short, CPA focuses on non-paying users, while CAC measures the cost of acquiring actual customers.

Why is benchmarking CAC against industry standards important?

Benchmarking CAC against industry standards is important because it provides insight into your standing in the industry and identifies areas for improvement. It helps you understand how your customer acquisition cost compares to that of your peers, giving you a clear direction for making strategic adjustments.