Struggling to make complex business decisions? How do you weigh your options and predict outcomes more effectively? Enter Decision Tree Analysis, a transformative tool for making complex business decisions.

But first, what exactly is a Decision Tree? In simple terms, it’s a flowchart-like structure that helps you visualize the consequences of various choices and paths. It’s like a map that guides you through a series of decisions, showing different outcomes based on different choices. Each ‘branch’ of the tree represents a possible decision or occurrence, allowing you to see the potential end results of each path.

The significance of decision tree analysis in business

Now, why is this important? Every decision can have a lasting impact on business, and it’s crucial to weigh these outcomes strategically. Decision Tree Analysis isn’t just a method; it’s a powerful visual tool that transforms abstract choices into clear pathways.

Imagine being able to chart each decision, consider various outcomes and their probabilities, and guide yourself toward the most financially sound choices. Whether you’re a startup grappling with growth strategies or an established business deciding on resource allocation, Decision Tree Analysis can be an ally.

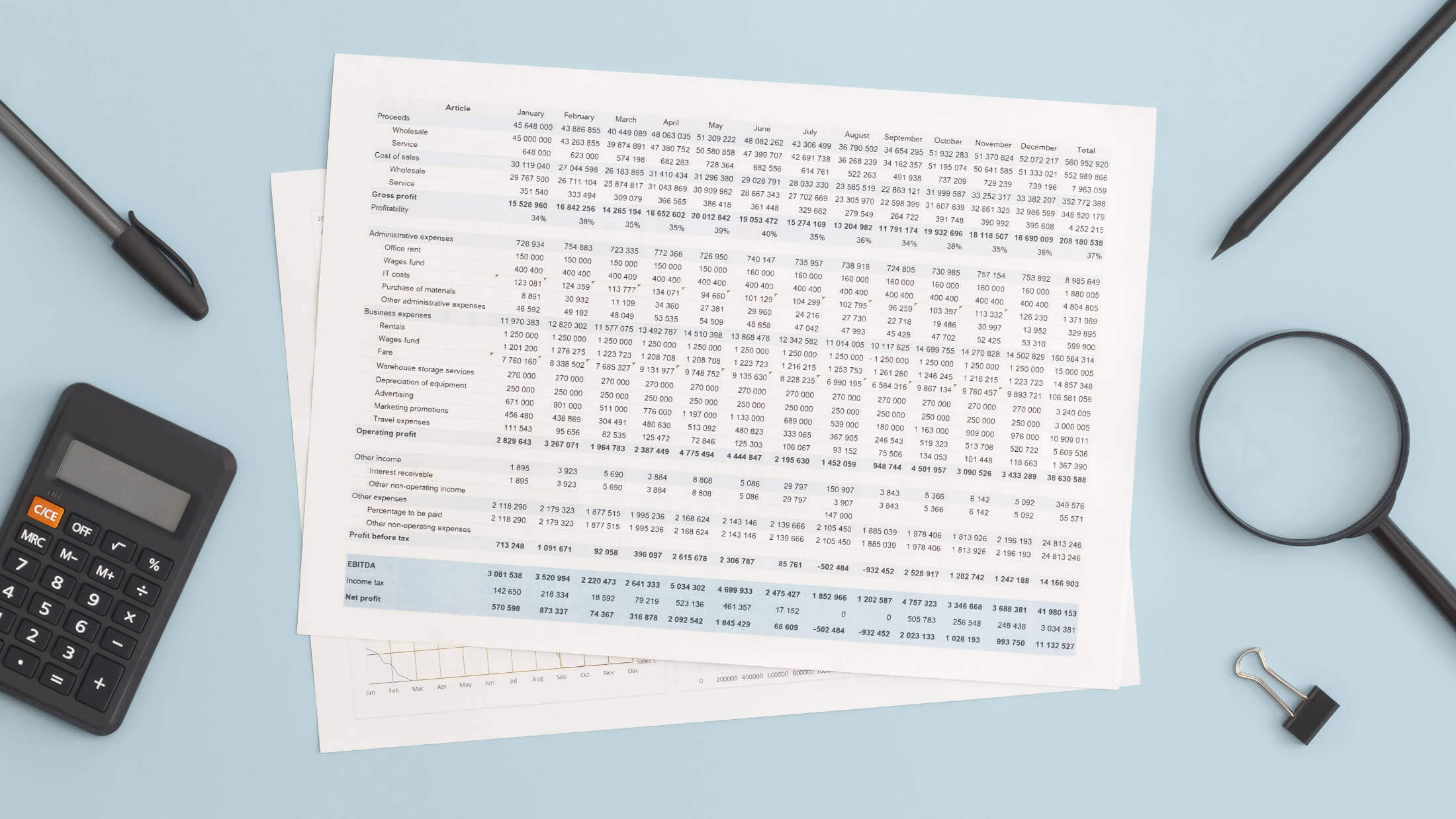

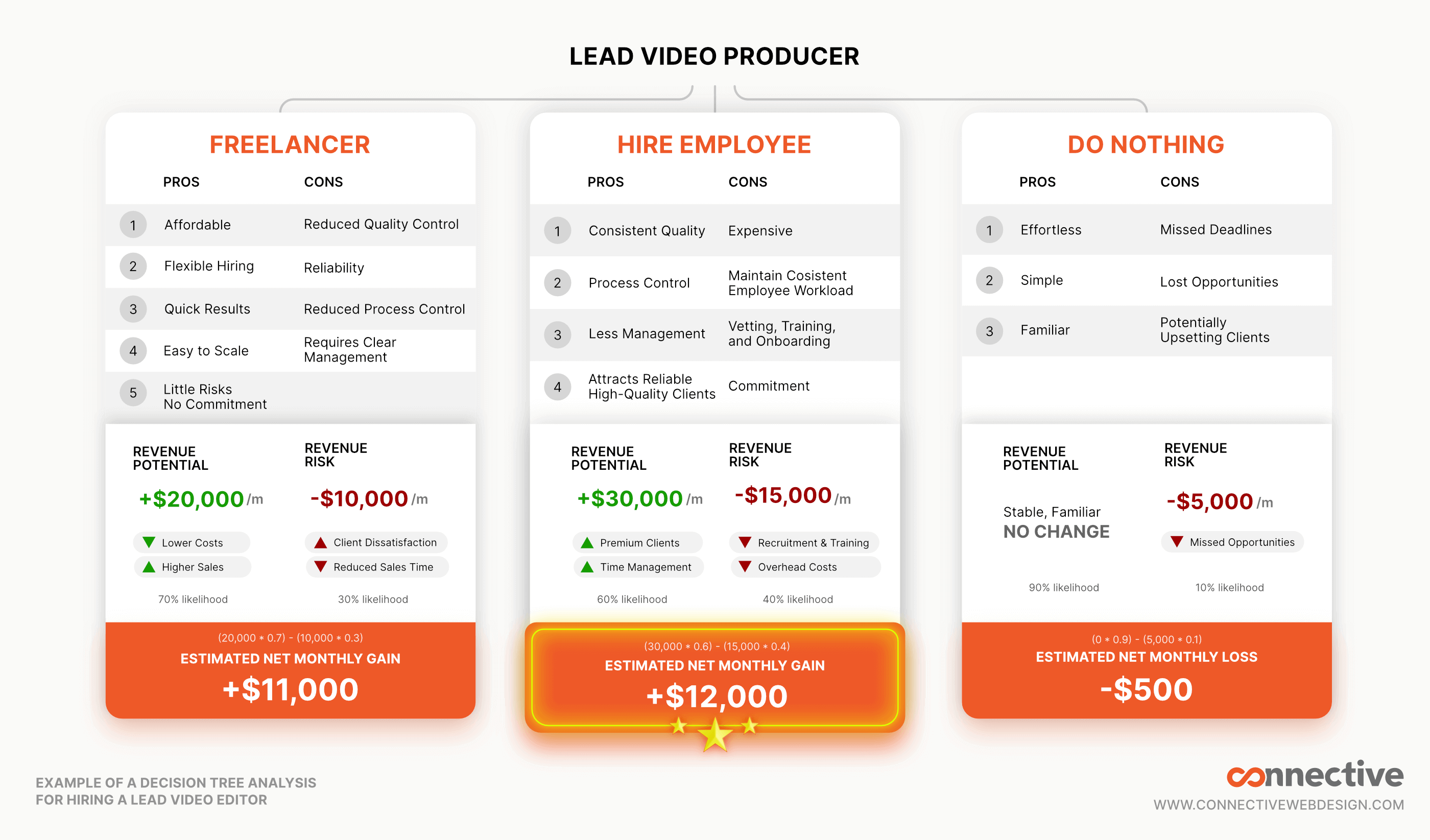

Let’s dive deeper into how Decision Tree Analysis can be applied in real business scenarios. In our following example, our revenue projections are informed by historical data, market analysis, and predictive modeling, but some of the figures may involve educated guesses.

Understanding connective’s growth and challenges

Our video department is getting overloaded, and with many opportunities ahead, we find ourselves at a crossroads. This growth creates an ideal case study for applying Decision Tree Analysis, illustrating the process, and should provide insights into the practical benefits and considerations.

We have three options: outsourcing, hiring a full-time employee, or maintaining the status quo. Each path offers distinct advantages and challenges, and our decision will significantly impact our business.

Let’s use Decision Tree Analysis to navigate the complexities and guide us toward the most strategically sound choice.

The outsourcing option

So, what are the Pros and Cons of Outsourcing?

For pros: It’s cost-effective, scalable, quick to set up, and requires low commitment.

And cons: There are quality and reliability concerns, and more management is required.

Financial Implications of Outsourcing

Outsourcing has a potential revenue gain of $20,000 monthly with a 70% likelihood. However, there’s a 30% chance it could result in a $10,000 loss. This gives us a net expected value of $11,000.

At this decision node, one path represents a 70% likelihood of gain, while the other indicates a 30% chance of loss. We calculate the net expected value by multiplying each outcome by probability and summing the results.

Outsourcing can save money, but there may be quality issues. We calculated a net value of $11,000.

Hiring a full-time employee

So, what are the Pros and Cons of Hiring an Employee?

The pros: Improved quality, streamlined processes, less management, and potential for attracting bigger clients.

The cons: Higher costs, the responsibility to keep them busy, a longer process to vet and onboard, and greater risk if the hire doesn’t work out.

Financial Implications of Hiring an Employee

Hiring an employee could increase monthly revenue by $30,000 with a 60% chance. However, there is a 40% chance of a $15,000 loss. The net expected value is $12,000.

At this decision node, one branch signifies a 60% probability of a significant revenue boost, and a ‘weaker’ branch indicates a 40% risk of loss.

Hiring an employee carries both the potential for significant revenue increase and shows risks resulting in a net expected value of $12,000.

The status quo

So, what are the Pros and Cons Maintaining the Status Quo?

Pros: No additional effort or change is required, and it is easy.

Cons: Risk of falling behind on current work, missed growth opportunities, and potential client dissatisfaction.

Financial Implications of Doing Nothing

Sticking with the status quo has a 90% likelihood of maintaining current revenue, but there’s a 10% chance it could lead to a $5,000 loss, resulting in a net expected value of a -$500 loss. This option might seem safe, but it doesn’t allow for growth or the ability to handle more clients, which could stunt growth.

Staying the course may seem safe, but it risks missing growth opportunities. The decision tree indicates a net expected value of -$500, showing the potential cost of inaction.

Conclusion – Making the decision

After a thorough analysis, hiring a full-time employee emerges as the most favorable option with the highest net expected value. This decision, illuminated by the Decision Tree Analysis, aligns strategically with our goal of expanding capacity and revenue.

Decision Tree Analysis has some limitations that should be considered. Its accuracy relies on the quality of input data and objective probability estimates. There is a possibility of bias and oversimplification, so it should be used as part of a broader decision-making process alongside other tools, instinct, and judgment.

In summary, Decision Tree Analysis aids decision-making by providing a structured, visual approach to evaluating options. However, it doesn’t replace the need for sound judgment and intangibles beyond the numbers. How might you use Decision Tree Analysis in your world?